Energy Trading

Our commodity trading business sits at the heart of our power and gas portfolio. This volatility creates opportunities for leaders that understand their risk profile and true exposure and use this information to drive profitability, operational excellence and cash flow.

GE Power aims to connect its platform with energy trading

GE Power aims to connect its platform with energy trading

And it helps ensure that the supply of competitively priced energy remains secure for millions of customers.

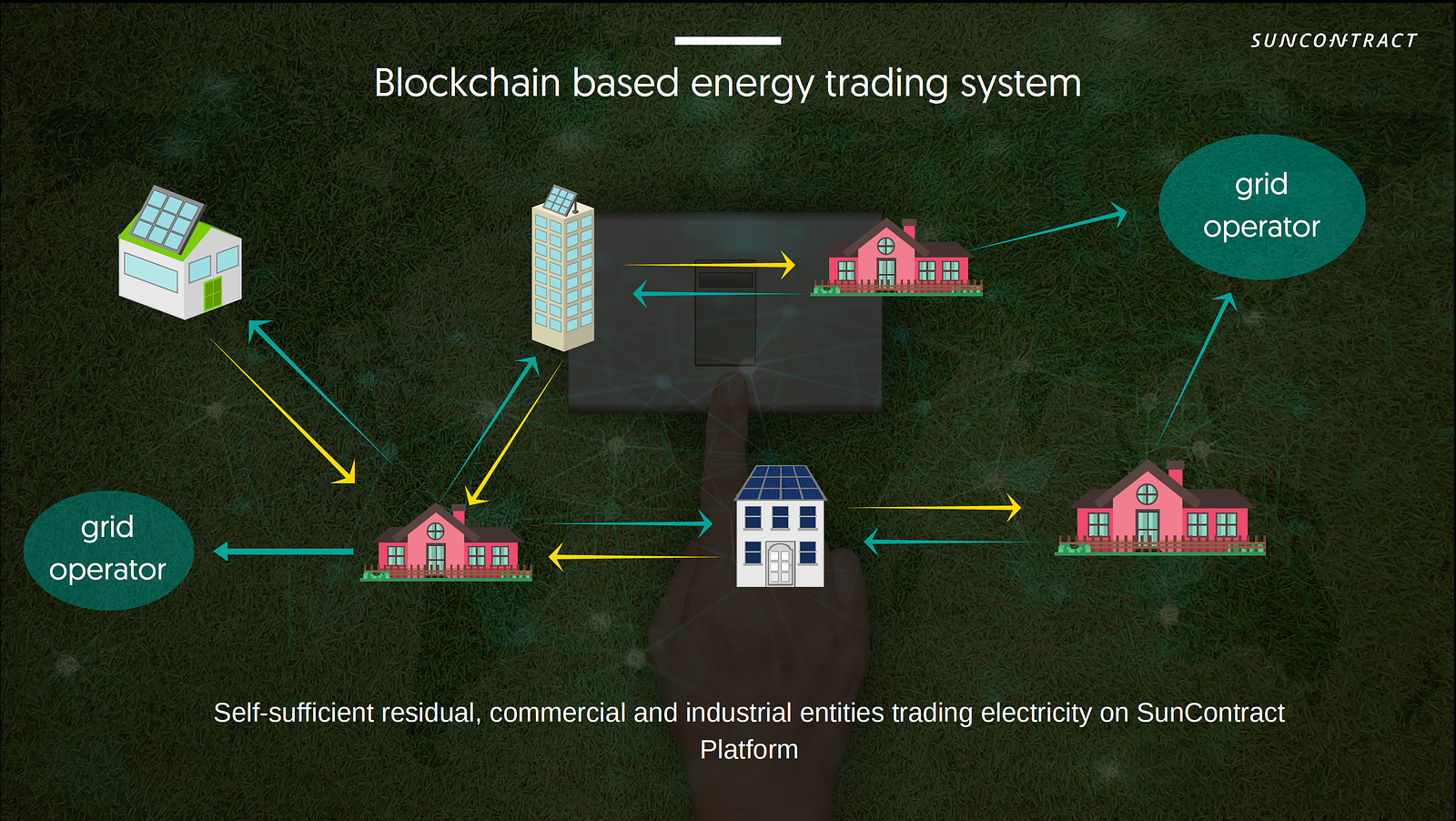

Energy trading. P2p energy trading is an essential model to improve the energy system flexibility for a low carbon energy transition. Moreover, p2p allows the proliferation of the use of renewable energies at the residential level. Natural gas, crude oil, coal and electricity have all experienced significant volatility in the past 18 months.

However, many factors other than commodity prices can affect the performance of energy company share prices: About us explore our services we work with energy partners, Energy markets are commodity markets that deal specifically with the trade and supply of energy.energy market may refer to an electricity market, but can also refer to other sources of energy.typically energy development is the result of a government creating an energy policy that encourages the development of an energy industry in a competitive manner.

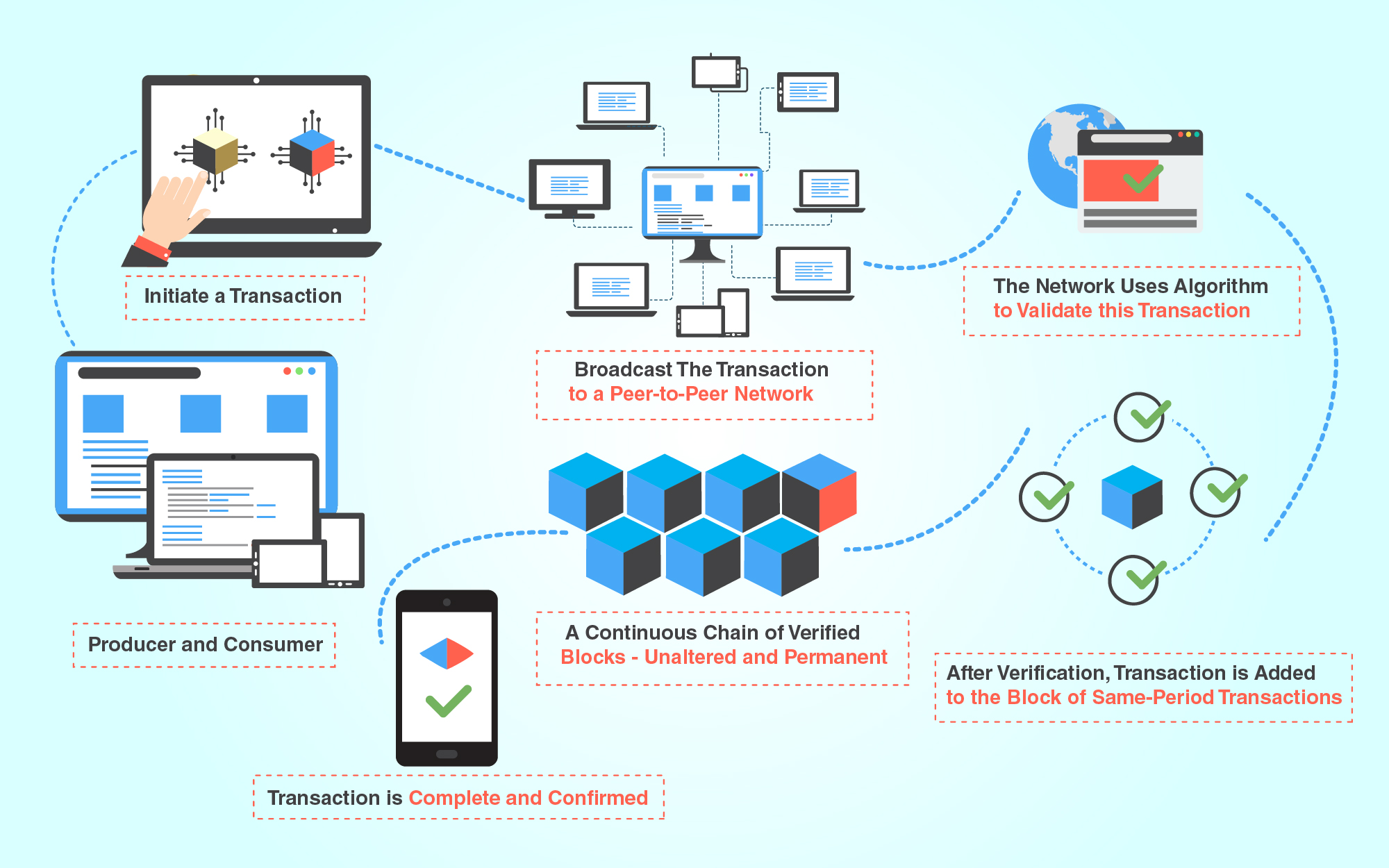

Flexible p2p energy trading using blockchain technology to optimally match trades. Trading is a business that incurs costs, losses, taxes, uncertainty, stress and risk. We trade and optimise assets across wholesale and balancing markets, ancillary services and through bespoke bilateral trading agreements.

In theory, then, trading energy company shares is a way to make a leveraged bet on the price of energy commodities. Since these commodities often fluctuate abruptly they can be attractive to speculators. Proactive energy trading is an indigenous oil and gas servicing company with key partnerships and strategic alliances for consistent performance, safe operations and a dedication to exceptional services.

Eco efficient trading is a multinational company that has been working in global trading throughout the world for over 20 years. Futures contracts are used by investors to reduce their exposure to price fluctuations of the underlying assets. A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar.hard commodities are mined, such as gold and oil.

Energy commodity markets are among the most volatile markets in the world. This ensures surplus power usage is always maximized without retail power companies having to respond to market fluctuations. 6.1. It optimizes and dispatches our generation assets, guides our gas business (transport, storage, and wholesale marketing), and manages risk.

International energy trading is the traditional core business of the axpo solutions ag division. The solar panels were installed in 2015 by repowering, a social enterprise set up to facilitate community owned energy We are united by our common objective:

Vest energy provides trading and optimisation services to energy storage and renewable asset owners. According to tokyo and tokyo tech, the primary goal of the p2p energy trading system is the profits of prosumers and consumers. To manage risk efficiently and optimise portfolio value in order to maximise profitability for vattenfall and our customers.

As the commodity’s price rises, more revenues should flow to the bottom line in the form of profits. We have established ourselves as one of the leading experts in global trading and have formed fruitful connections with several clients and partners throughout the world. Energy trading’s first female ceo insists on business as usual.

Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards. A global team with local knowledge.

We are a global energy business, with unique skills and insights to keep the world’s energy moving. The target community was an estate in hackney that had solar panels installed on 14 of the blocks of flats. Futures contracts are the oldest way of investing in commodities.

Around 410,000 energy customers will be moved to new providers after green network energy and smaller firm simplicity energy stopped trading. Energy trading energy trading involves products like crude oil, electricity, natural gas and wind power. Energy futures represent contracts to either buy or sell one of the fossil fuels or products related to them at a predetermined future date and price.

Edf energy will be the new supplier for green network energy customers and british gas evolve will take on simplicity energy’s customers. Energy traders association (etd) was founded by leading energy trading companies holding electricity wholesale licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in turkey. Therefore, we set out to power a social housing community with sunshine using our energy trading platform.

Gas and power What we do Global energy trading

Gas and power What we do Global energy trading

Predict the Unpredictable Power Forecasting and Energy

Predict the Unpredictable Power Forecasting and Energy

Brochures Features and updates Global energy trading

Brochures Features and updates Global energy trading

Power Ledger to trial blockchain energy trading in Italy

Power Ledger to trial blockchain energy trading in Italy

peer to peer energy trading Archives 100 Renewables

peer to peer energy trading Archives 100 Renewables

Lition is The World’s First Operational PeertoPeer

Lition is The World’s First Operational PeertoPeer

Understanding P2P Energy Trading The Startup Medium

Understanding P2P Energy Trading The Startup Medium

Solar Power Trading Here is how it works. Regen Power

WePower partners with 220 Energia to offer green energy

WePower partners with 220 Energia to offer green energy

Blockchain Energy Trading and its Applications iTouchVision

Blockchain Energy Trading and its Applications iTouchVision

Verv’s Free Market Model; What are the Advantages of a

Verv’s Free Market Model; What are the Advantages of a

Energy Trade in South Asia Opportunities and Challenges

The current reality of peertopeer energy trading for

Power Ledger Enables Blockchain Energy Trading for

Power Ledger Enables Blockchain Energy Trading for

E.ON, EDF, RWE, Sweden’s StateOwned Vattenfall and Others

E.ON, EDF, RWE, Sweden’s StateOwned Vattenfall and Others

Power Ledger and BCPG team up to launch SE Asian REC

Power Ledger and BCPG team up to launch SE Asian REC

Comments

Post a Comment